Justin Harter is a copywriter, website consultant, & narrative nonfiction writer

Combining stories people want to read with the skills to make your website better

If your website has a bunch of “content” but doesn’t say something people want to read, I can change that.

My new book, The Great Tri-State Tornado, is now available

You can pre-order your signed or unsigned copy now directly from me.

The Great Tri-State Tornado will also be available at Walgreens, select Wal-Marts, and through other regional and large book sellers and online stores.

More featured projects and work

Get industry-leading brand journalism, stories, blogs, and landing pages to increase website traffic and sales

I help small businesses, nonprofits, and governments talk to humans and bots. You’ll get blogs that read and sound like they were written in-house.

- Improve your website rank in Google and SEO

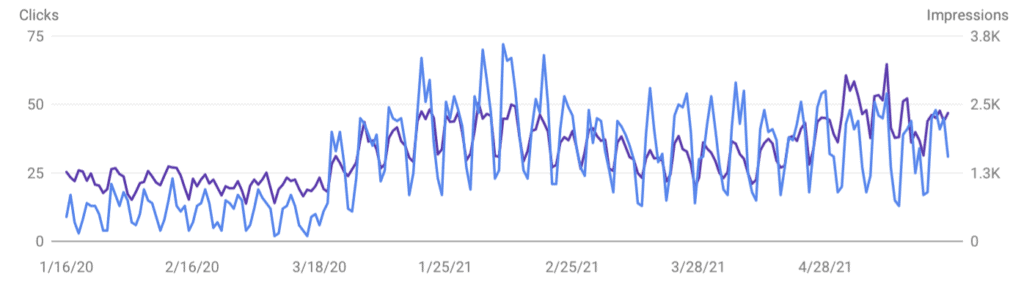

- My average client doubles their traffic in 3 months and triples it in about a year

- Give your team actionable, new strategies

- Impress everyone with more revenue

No industry is too niche. Whether you offer B2B training, youth outreach, government services, or just want help sharing case studies and client successes it all starts with an email.

Because business should be an act of friendship. Made by a real person.

Nothing I do or touch is made by some faceless corporation, it’s made by a real person. Thank you for supporting someone who cares about lovingly crafting and growing real things for real people.

I’m a website copywriter in Indianapolis working for clients nationwide

There’s a way to make your website better.

I’ve done copywriting, ghostwriting, landing page writing, website consulting, and “content marketing” for 15+ years for over three dozen clients like you.

My work combines narrative nonfiction, storytelling, and brand journalism.

I’m doing work for a maximum of 7 clients.

These are some of who I’m working with.

You should become one before space is gone.

👷♀️ | An Indianapolis-based engineering firm

🎓 | Indiana University

👨👨👦 | Indiana-based child welfare agencies

🦺 | A national training firm

🕰 | A Missouri Historical Society and museum

👾 | An indie game app developer

💭 | A spot for you

Here’s how Justin can be your go-to storyteller and website consultant

Website Consulting

Get your existing website reviewed for search placement, keywords, and a second opinion on how your site is performing.

Content Marketing

The term has lost favor, but let’s call it what it is: writing for audiences on Google and Facebook. They’re out there, so get them on to your site.

Research

Get research-backed genealogical research, surveys, case studies, and other evidence to back up your name, family, brand, or business. Just look at some of the results people get on the web.

Local SEO

The best local SEO comes from great localized material like that customer you helped here in town, or the team you sponsored. Don’t keep it a secret!

Plus other great ways to enhance and learn about writing for the web

Speaking

Need a speaker for your event, podcast, webinar, or training?

I’ve organized and spoken at leading web and educational conferences like the Indiana Teacher’s Association, Indiana Judicial Conference, and more.

Copywriting

Get website copy that converts to sales or leads for your sales team.

And even if they don’t convert to sales, let’s try to generate future ones by getting people interested in your email list.

Email marketing

Email isn’t dead. In fact, it’s probably your best sales channel.

Small businesses that can’t afford to run large TV or radio campaigns should instead lean more heavily on their email lists—it’s open, doesn’t rely on algorithms, and it’s affordable.

Consultations

My clients get time with me 1:1.

Get custom strategies and ideas that fit your goals, your team, and your budget starting at $500/mo.

Recent Posts & THOUGHTS

A new review of the Astropad Rock Paper Pencil v3 iPad screen protector

First things first: the people at Astropad reached out to me a few weeks ago…

Steve Jobs’ commencement speech made me quit my job twice

Steve Jobs was such a good writer, and not bad at speaking either! His Stanford…

The 16GB 1TB iPad Pro model is, in fact, noticeably better

The three classes of work (guess which one you do a lot of)

Summer is when I generally start thinking about big transitions in my work, my teaching,…

Thoughts on moving to Michigan because of Mike Pence’s fountain

When Henry David Thoreau spent his eponymous time at Walden Pond, he wrote: “I went…

Scoring and grading students in the age of AI

Thoughts on thinking Following the Truman maxim, “The only thing new is the history you…